New publication: The emerging cobalt challenge: Competition, Concentration, and Compliance

As cobalt demand rises companies are increasingly facing the triple challenge of competition, concentration, and compliance. In this paper we explore the state of the market, the challenges companies face in sourcing cobalt and the potential compliance challenges in the market.

You can access the full paper here or read a summary below.

The report was featured exclusively in the Wall Street Journal here, while our Director, Harrison Mitchell also expanded on the report findings in an article for the compliance blog FCPA.

If you are interested in speaking with RCS Global about cobalt supply chain compliance or any other mineral supply chain issues please feel free to contact at any stage via [email protected]

Summary: The emerging challenge

“Cobalt demand is set to rise significantly as nascent demand from the electric vehicle market comes on line. At the same time, cobalt supply is tightening, with the world’s primary producer – the Democratic Republic of Congo – suffering from crumbling infrastructure and massive human rights challenges.”

Dr. Nicholas Garrett, Director at RCS Global.

This is the prospect manufacturers across the electrical manufacturing and electric vehicle market face in the next two years. From smartphones, to tablets, and from power tools to medical equipment, cobalt is the small but critical component powering the consumer tech revolution witnessed in the last decade. The cobalt powered lithium-ion batteries found in this technology is now also set to be the catalyst behind the imminent large-scale commercialisation of electric vehicles.

Yet, cobalt is a concentrated and complex market, dominated by one producer. The Democratic Republic of Congo (DRC), responsible for around 60% of global supply. As a consequence of a prolonged conflict and profound economic mismanagement in the 1990s, DRC’s once strong industrial mining sector has given way to a complex and largely unregulated cobalt sector, which many of the biggest companies in the world now have to grapple with.

At the same time, scrutiny from campaign pressure groups is increasing, forcing companies to further ensure transparency in their supply chains within the DRC. The recent Amnesty International Report and the Washington Post investigation are the best examples of this trend.

Regulators and Industry are waking up to the cobalt challenge

As a result of these challenges, a handful of major companies are moving to treat cobalt supplies in the same category as ‘conflict minerals’, which by law, are currently limited to gold, tin, tantalum and tungsten (3TG).

At the moment, this re-classification is industry-led with a few leaders setting the new standard but regulatory changes to incorporate cobalt are now a realistic possibility with the OECD leading a drive to expand supply chain transparency and due diligence to other commodities.

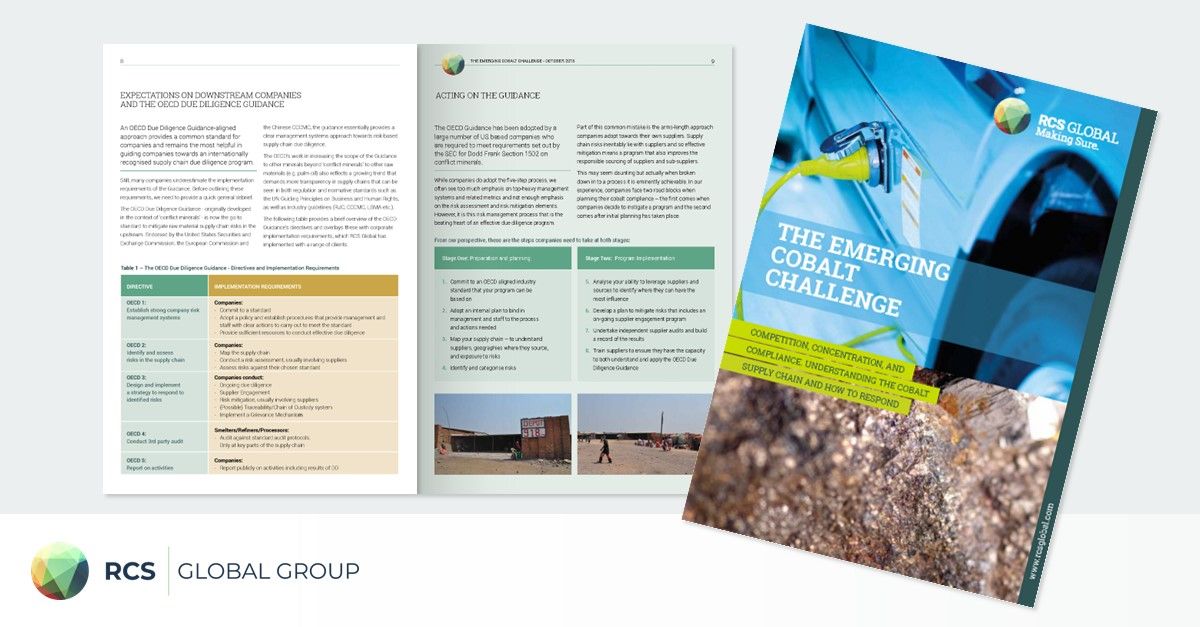

The OECD’s ‘Due Diligence Guidance’ is an aligned approach that provides a common standard for companies and remains the most helpful in guiding companies towards an internationally recognised supply chain due diligence program.

“Originally developed in the context of ‘conflict minerals’ and endorsed by the United States Securities and Exchange Commission, the European Commission and the Chinese CCCMC, the OECD’s Guidance is now the go-to standard to mitigate raw material supply chain risks in the upstream.”

Harrison Mitchell, Director at RCS Global.

The state of the DRC and how risk can be managed

In the new RCS Global Report, further detail on the state of the market is highlighted, while the risk profile and potential human rights and labour rights threats currently present in DRC are laid out in full.

The report also goes on to offer a road map for the thousands of midstream and downstream companies now grappling with how to ensure their DRC cobalt supply chains can be ethical, “conflict free” and future-proofed against the compliance challenges coming over the horizon.

Through Dodd-Frank 1502 and especially through the OECD’s Due Diligence Guidance, much of the groundwork for a cobalt compliance program has been done. So if companies can set up due diligence programs, which follow the OECD’s framework then it is more than likely they’ll be future-proofed against compliance and regulatory risks coming down the line.

“Many companies underestimate the implementation requirements of the Guidance itself. The biggest error we see is companies not realizing that in the eyes of the OECD Guidance, they are responsible for the conduct of their partners throughout their supply chain right down to the mine. Companies like Apple have acknowledged this and are pushing out their due diligence across their supply chains but many others see this as a daunting prospect. It needn’t be. In the same way that much of the regulatory groundwork has already been done, so the due diligence industry has matured as well. There are researchers and consultancies who have built up specialist cobalt expertise and can steer companies through this compliance challenge. But these companies must start the process now – if they don’t, they risk being caught out.”

Harrison Mitchell, Director at RCS Global